Don't Miss Your Chance to Save 35%!

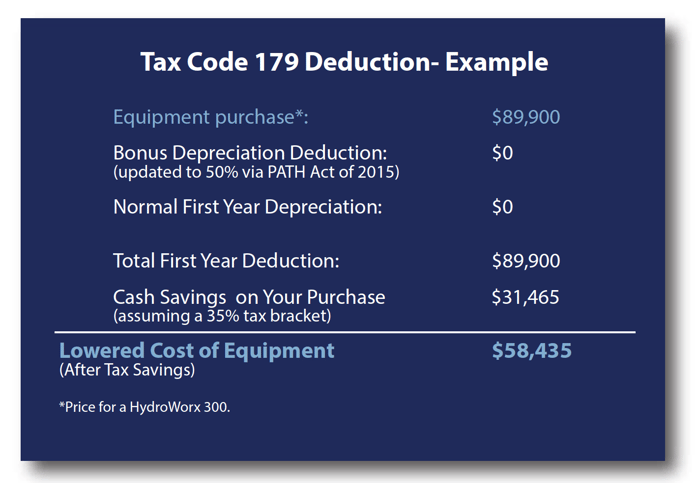

The S ection 179 Tax Deduction could help save you more than 1/3 of the cost of a HydroWorx!

ection 179 Tax Deduction could help save you more than 1/3 of the cost of a HydroWorx!

Combined with our great financing programs, you could be treating patients and earning money with aquatic therapy by the end of the year.

Highlights of Section 179:

- The tax break will allow business to deduct up to $500,000 of the purchase price of new equipment purchased in the 2017 calendar year.

- The equipment must be financed or purchased and put into service by the end of the day 12/31/2017.

- 2017 Spending Cap on equipment purchases is $2,000,000.

Note: Due to production lead time frames, orders will need to be placed by September 15, 2017 in order to take advantage of the Section 179 deduction.

Consult your tax advisor to understand if you're eligible for the tax break. Also see www.section179.org and www.irs.gov.